Flood Insurance That Shields Your Property, and Your Peace of Mind

Trailstone helps you find flood insurance through NFIP and private carriers, protecting your home or business from costly damage caused by storms, rising water, or flooding.

Coverage That Stands When the Water Rises

Flood Insurance protects your home and belongings from damage caused by rising water, coverage most standard home policies do not include.

Protection for your property

Covers damage to your home’s structure, including walls, floors, and major systems like plumbing and electrical.

Coverage for your belongings

Helps replace furniture, clothing, electronics, and other personal items lost to floodwaters.

Financial security during recovery

Provides funds to help you rebuild and replace what you lost without draining your savings.

What Your Flood Policy Can Protect

Flood insurance can cover multiple areas, not provided in standard policies:

Building Coverage

Repairs to the structure, foundation, and built-in systems.

Contents Coverage

Your belongings, furniture, electronics, clothing, and more.

Additional Living Expenses (ALE)

Temporary housing and related costs during repairs (usually available only with private policies).

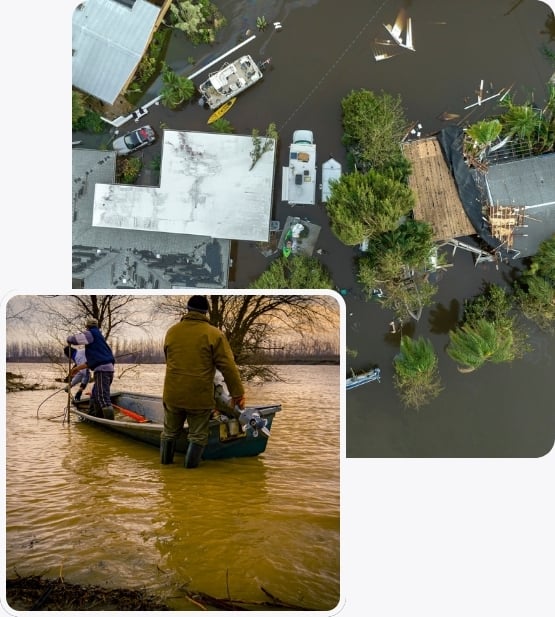

The Disaster Your Home Policy Will Not Cover

Many homeowners do not realize until it is too late that their regular home insurance does not cover flood damage. By the time the water recedes, the financial damage can be just as devastating as the physical destruction.

Why the risk is greater than most think

• Heavy rain can flood a home far from any river or coastline

• Melting snow can send water into basements and crawl spaces

• New construction can change drainage patterns and put your home at risk

Flood Insurance ensures you have the means to rebuild and move forward, even when the waters rise unexpectedly.

Hear from current clients

Jimmy Maginas was very helpful and considered my personal needs like: including a rental car if mine was in the shop, which I did not need because I have a second card, and also whether I needed flood insurance, again not. These examples to illustrate that it’s important to work with a thinker and a doer, like Jimmy Maginas.

— Kyle C. Arvada, CO

Your Path to the Best Flood Insurance

Getting the right insurance should not be confusing or stressful. With our four-step process, you get protection you can trust and the confidence of knowing that when disaster strikes, so that you know you are covered the right way.

Start With a 15-Minute Call

No one else has your exact life, your business, or your priorities. On this call, we dig into what matters most to you and build a policy around it. No generic quotes. No guessing. Just coverage that’s right for you.

Know Your Options. Protect What Matters.

We check with 40+ A-rated carriers and send a simple video that explains your best coverage options—so you can choose confidently without feeling rushed or pressured.

Make a Confident Choice

After reviewing your options, we make adjustments as needed so your policy fits just right. No more paying for the wrong coverage or putting off peace of mind.

Switch With Confidence. We’ll Handle the Rest.

Forget the hassle of starting over. We make sure your new coverage is in place and your transition is seamless—because getting protected should feel easy.

FAQs

At Trailstone Insurance Group, we believe insurance shouldn’t be complicated. Below are some of the most common questions we hear from customers. If you don’t see your question here, feel free to contact us or speak directly with an agent, we’re here to help.

Is flood insurance included in my homeowners policy?

No. Standard homeowners insurance does not cover flood damage. You need a separate flood insurance policy to protect your property from water-related losses.

What does flood insurance cover?

Flood insurance covers damage to your home’s structure, electrical and plumbing systems, major appliances, and personal belongings. It can also cover cleanup and repair costs.

Who needs flood insurance?

Anyone living in a flood-prone area should consider it. In fact, mortgage lenders often require flood insurance if your home is in a high-risk flood zone.