Cyber Insurance That Protects Your Business from Digital Threats

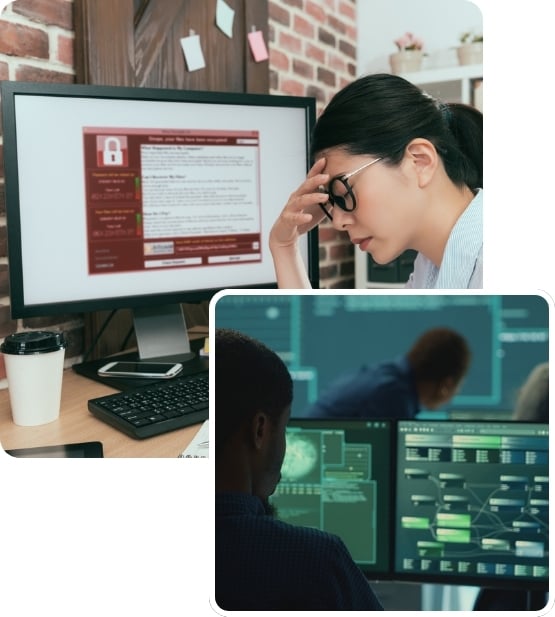

A single cyberattack can halt operations, compromise sensitive data, and cost your business thousands in recovery expenses.

Cyber Insurance helps cover the costs of data breaches, ransomware attacks, network outages, and other cyber incidents, whether caused by hackers, human error, or rogue employees.

At Trailstone, we help place coverage that protects your finances, reputation, and customers.

When Your Biggest Threat Is Invisible

Cyber Insurance protects your business from the financial fallout of data breaches, cyberattacks, and other online threats that can cripple operations and damage trust.

Coverage for data breaches

Helps pay for notification costs, credit monitoring, and legal expenses if sensitive information is exposed.

Business interruption protection

Covers lost income and extra expenses when a cyber event shuts down your systems.

Support for recovery and reputation

Provides access to experts who can help restore data, repair systems, and manage public relations after an incident.

What Cyber Insurance Can Cover

Protection for the Costs and Consequences of a Cyber Event:

Data Breach Response

Covers investigation, customer notification, and credit monitoring services.

Cyber Extortion

Ransomware payment assistance and negotiation support.

Business Interruption

Income loss and extra expenses during a network outage caused by a cyber event.

Data & System Restoration

Cost to repair or replace corrupted files and damaged systems.

Liability Claims

Legal defense and damages if customers or partners sue over a breach.

Regulatory Fines & Penalties

Coverage for certain fines related to privacy law violations.

The Click That Could Cost Everything

Cyber threats can hide in plain sight until they suddenly bring your business to a halt. One click on the wrong email or a vulnerability left unpatched can set off a chain of costly consequences.

How a cyber event can hit your business

- Ransomware locks you out of every file until a payment is made

- Hackers steal customer credit card data and demand hush money

- A phishing email tricks an employee into wiring funds to criminals

Cyber Insurance helps you recover quickly, protect your clients, and keep your business moving forward even after an attack.

Hear from current clients

"We had a great experience with Cody at Trailstone. He did research for us, sought advice from his colleagues, and made sure our requirements were met. Highly recommended!"

Lisa R., Littleton, CO

Your Path to finding the Best Cyber Insurance

Getting the right insurance should not be confusing or stressful. With our four-step process, you get protection you can trust and the confidence of knowing that when disaster strikes, so that you know you are covered the right way.

We Listen First

You want to protect your business, but you’re not sure where to start. That’s where we come in.

Because before we can protect your business, we need to know your business.

Let Us Do The Heavy Lifting

You stay focused. We handle the details. You’ll receive real options built around your needs, not just your business type.

With access to 100+ carriers and strong industry relationships, we deliver quotes tailored to your business.

Clear, Comparable Options

We explain how each policy works with real claim examples, share our honest recommendation, and answer every question on the spot.

You’ll know exactly what you’re buying and why.

Switch With Confidence. We’ll Handle the Rest.

You choose the coverage, we handle the rest. From final negotiations to certificates.

When you have a question, we’re here to help.

FAQs

At Trailstone Insurance Group, we believe insurance shouldn’t be complicated. Below are some of the most common questions we hear from customers. If you don’t see your question here, feel free to contact us or speak directly with an agent, we’re here to help.

How much Cyber Liability Insurance do I need?

It depends on your exposure. A doctor’s office with HIPAA data may need $1M+, while a small retail shop may need $250k–$500k. Our TRAC process helps align coverage with your risk profile.

How much does Cyber Liability Insurance cost?

Small businesses often pay $500–$1,500 annually. Costs depend on revenue, data handled, and security controls. Trailstone shops 40+ A-rated carriers to keep premiums competitive.

I’m a small business. Do hackers even target me?

Yes. Hackers often target small businesses because defenses are weaker. Many attacks are automated, your size doesn’t protect you.

Helpful Resources

Insurance shouldn't feel confusing. Our Learning Center gives you clear, helpful information so you can make confident choices about your coverage.