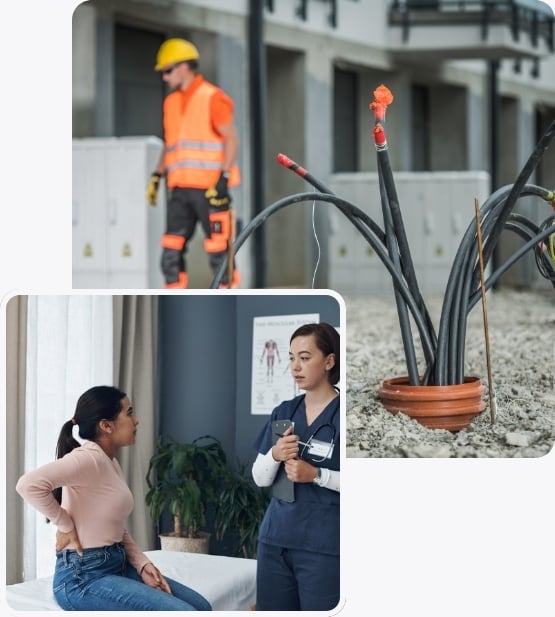

Protect Your Team, and Your Business with Workers Compensation Insurance

Trailstone helps you find workers compensation insurance that meets state laws, protects your team, and shields your business from financial risk so you can focus on serving customers.

Why Workers’ Compensation Is More Than a Legal Requirement

Workers’ compensation is not just another box to check for compliance. It is a safety net for your team and a safeguard for your business. The right coverage protects both your people and your bottom line when accidents happen.

It protects your employees

If a worker is injured or becomes ill because of their job, workers’ compensation covers their medical bills, rehabilitation, and a portion of their lost wages so they can recover without financial strain.

It protects your business

When coverage is in place, it can prevent costly lawsuits and cover legal expenses if a workplace injury leads to a dispute.

It builds trust in your workplace

Employees who know they are protected feel more secure and valued, which can improve morale and retention.

Trusted Workers’ Comp Carriers We Partner With

Trailstone Insurance Group works with some of the most respected workers’ compensation carriers in the industry. These partnerships give our clients access to competitive rates, comprehensive coverage, and proven claims support, so your team stays protected and your business stays compliant.

The Hartford

Offers tailored workers’ comp solutions for a wide range of industries, with a strong focus on fast claims handling and effective return-to-work programs to minimize downtime.

Travelers

Known for competitive workers’ comp rates and advanced risk control services that help prevent injuries and reduce overall claim costs.

Liberty Mutual

Provides industry-specific workers’ comp programs supported by safety training, claims expertise, and resources to help keep employees protected and businesses compliant.

AmTrust

Specializes in workers’ comp for small to mid-sized businesses, delivering affordable coverage and proactive loss control to reduce workplace incidents.

Berkshire Hathaway Guard

Combines competitive pricing with comprehensive workers’ comp protection, including flexible payment options and strong claims support.

Employers

Focused solely on workers’ comp for small businesses, offering cost-effective coverage, fraud prevention tools, and efficient claims management.

Auto-Owners Insurance

Provides personalized workers’ comp coverage through independent agents, with a reputation for attentive claims handling and responsive service.

Pinnacol Assurance

Colorado’s largest workers’ comp carrier, offering deep knowledge of state-specific regulations, strong safety programs, and hands-on claims management.

Secura Insurance

Delivers flexible workers’ comp policies with competitive rates and practical safety resources to help businesses prevent injuries and control claims costs.

State Fund vs. Open Market Workers’ Comp, What’s the Difference?

State funds are government-run programs that guarantee coverage, even for high-risk industries or businesses with multiple claims. They’re a reliable safety net but often come with higher rates and fewer options.

Open market policies are offered by private insurers, giving qualified businesses access to competitive pricing, broader coverage, and more flexibility.

Trailstone knows when a state fund is the right fit and when the open market can save you money. We’ll guide you to the option that best protects your team and your bottom line.

Hear from current clients

"Getting workers’ comp was way easier than I thought. Trailstone handled everything. Five stars."

Jason M. Portland, OR

FAQs

At Trailstone Insurance Group, we believe insurance shouldn’t be complicated. Below are some of the most common questions we hear from customers. If you don’t see your question here, feel free to contact us or speak directly with an agent, we’re here to help.

Is workers’ comp required by law?

Yes, in almost every state. Each state has its own rules, but if you have employees, workers’ comp is almost always mandatory. Failing to carry it can result in:

- Fines and penalties from the state.

- Lawsuits from injured employees.

- In some cases, business closure.

Trailstone helps you navigate state-specific rules so you’re never exposed.

Does workers’ comp cover subcontractors or 1099 workers?

Not automatically. If they don’t carry their own workers’ comp, you could be held responsible. Many small businesses assume “they’re 1099, so I’m safe”, but states often disagree. We’ll help you review certificates of insurance to protect yourself.

What does workers’ comp pay for?

- Medical care: doctor visits, surgeries, rehab.

- Lost wages: partial income replacement while they recover.

- Disability benefits: if they can’t return to work fully.

- Death benefits: financial support for dependents.

It’s not just a legal requirement, it’s how you take care of your people.

Explore Workers Comp Insurance in the Learning Center

Insurance shouldn't feel confusing. Our Learning Center gives you clear, helpful information so you can make confident choices about your coverage.