Commercial Property Insurance That Protects What You’ve Built

Trailstone provides commercial property insurance that protects your building, equipment, and inventory from fire, storms, and theft so your business can recover quickly after a loss.

Learn More About Commercial Property Insurance

From the roof over your head to the tools in your hands and the products on your shelves, every piece of your workspace keeps your business alive. Commercial property insurance protects these essentials so you can recover quickly after an unexpected loss.

It protects more than the building

Coverage includes furniture, computers, tools, and stock, even if you lease your space.

It keeps you running when disaster strikes

If fire, theft, or storm damage forces you to close temporarily, business interruption coverage can help replace lost income and cover ongoing expenses.

It can be tailored to your business

From a small retail shop to a large warehouse, policies can be customized for your location, industry, and specific risks.

Coverage for More Than Just Your Building

A well-designed policy goes beyond the walls of your building. Here’s what commercial property insurance can protect:

Buildings & Structures

Offices, warehouses, manufacturing facilities, and attached structures.

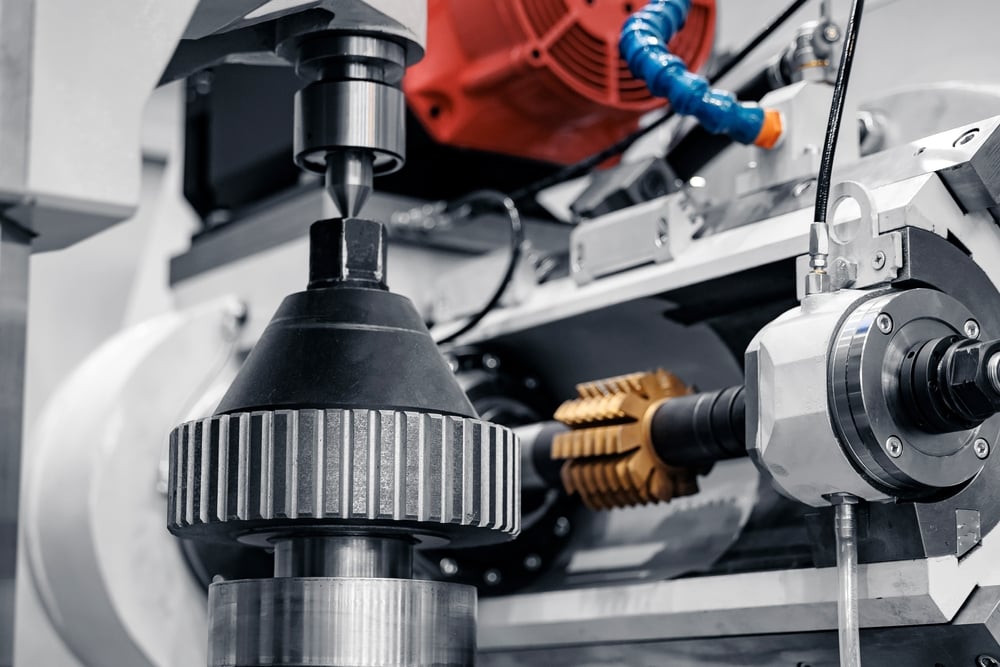

Equipment & Machinery

From office computers to heavy manufacturing equipment.

Inventory & Stock

Raw materials, finished goods, and retail products.

Furniture & Fixtures

Desks, shelving, lighting, and built-ins.

Business Records

Paper files and important documents.

Outdoor Property

Signage, fencing, landscaping, and detached structures.

The Overlooked Property Risk Most Owners Miss

Many business owners believe they are fully covered because they have some insurance on their building. The problem is, gaps in coverage often show up only after a loss.

Your policy may pay actual cash value, which might not cover the full cost to rebuild or replace. Certain disasters, like floods or earthquakes, are often excluded and require separate coverage. Inventory, tools, and equipment can also be underinsured if values are not reviewed regularly.

Hear from current clients

"Ricardo at Trailstone has been a Godsend. He is such a great guy to work with. With all of the stresses of running a company, insurance is the one thing that I don’t ever worry about thanks to him. Can’t say enough good things about them."

Eric S., Denver, CO

Your Path to finding the Best Commercial Property Insurance

Getting the right insurance should not be confusing or stressful. With our four-step process, you get protection you can trust and the confidence of knowing that when disaster strikes, so that you know you are covered the right way.

We Listen First

You want to protect your business, but you’re not sure where to start. That’s where we come in.

Because before we can protect your business, we need to know your business.

Let Us Do The Heavy Lifting

You stay focused. We handle the details. You’ll receive real options built around your needs, not just your business type.

With access to 100+ carriers and strong industry relationships, we deliver quotes tailored to your business.

Clear, Comparable Options

We explain how each policy works with real claim examples, share our honest recommendation, and answer every question on the spot.

You’ll know exactly what you’re buying and why.

Switch With Confidence. We’ll Handle the Rest.

You choose the coverage, we handle the rest. From final negotiations to certificates.

When you have a question, we’re here to help.

FAQs

At Trailstone Insurance Group, we believe insurance shouldn’t be complicated. Below are some of the most common questions we hear from customers. If you don’t see your question here, feel free to contact us or speak directly with an agent, we’re here to help.

What does Commercial Property Insurance cover?

- Buildings and structures you own

- Business personal property (furniture, inventory, computers, equipment)

- Business income (lost revenue after a covered loss)

- Extra expenses (costs of operating elsewhere after damage)

How much does Commercial Property Insurance cost?

Rates vary by building type, age, location, use, and value. Small businesses often pay $500–$2,500 per year, but Trailstone shops 40+ A-rated carriers to find the best option.

Can I combine multiple locations under one policy?

Yes. Many carriers allow scheduling multiple properties under a single policy for efficiency and cost savings.

Explore Commercial Property Insurance in the Learning Center

Insurance shouldn't feel confusing. Our Learning Center gives you clear, helpful information so you can make confident choices about your coverage.